https://www.furnishedfinder.com/property/339212_1

Anyone want to go on a tour, or go in on this purchase… we could create a theme park, or flip it. Just think of the possibilities and stories we could tell!

Check out the article HERE

Photo by Brett Sayles on Pexels.com

Keith Klassen, Real Estate Broker – 916.595.7900

Specializing in Residential Sales & Property Management

Posted in Real Estate

My dad emailed me this link saying, “I found this mesmerizing.” Check it out… I too was mesmerized! Its a site that tracks, in live time, categories such as, Death, Food, Water, Environment, Heath, etc.

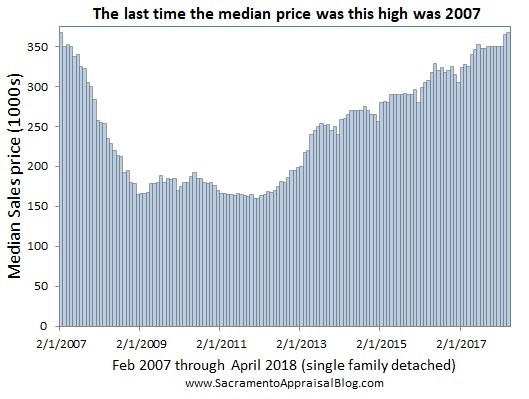

Here’s a snapshot of the Sacramento real estate market – maybe someone can add a live version to the worldometer website. Probably one of the best market updates is done by a friend and expert appraiser, Ryan Lundquist (Lundquist Appraisal Company). Check out his website and blog for more detailed market information on values in the Sacramento region.

You may be aware, each area of Sacramento is unique and the prices fluctuate depending on an array of factors. As a professional that has been in this business for over 13 years, I’m able to help you pinpoint the value of your home (as a potential seller), as well as assist you on analyzing your potential for buying. Send me a note or give me a call to discuss all your real estate needs.

Best,

Keith Klassen, Real Estate Broker – 916.595.7900

Specializing in Residential Sales & Property Management

Posted in Real Estate

Is 3D printing the future of home building? I had a conversation with a friend about 10 years ago about how China is using 3D technology to print buildings … this turned out to be a hoax. Just a few years later it was a reality – just go to YouTube and search to find many examples. Now the Netherlands are getting in on it with more artsy homes – see article HERE.

Photo by Somchai Kongkamsri on Pexels.com

This could become a whole new market as technology progresses at astounding rates. We use to wonder if certain ideas would come to fruition in our life time… now it may be a matter of a decade, or several years.

How will this affect the building industry? How will it affect the Real Estate profession? I can see it now for all you Realtors out there, tag line … Specializes in selling 3D Printed Homes!

Thoughts? Fears? Dreams?

It’s a brave new world!

Keith Klassen, Real Estate Broker – 916.595.7900

Specializing in Residential Sales & Property Management

HEREHERE

Posted in Real Estate

I’m so glad to hear that this project is back on track – a science, nature, and technology center! I’m also glad that our city is actually doing something this the River front. We are the river city after all, but it seems like the access points are few and far between. Discovery Park? Miller’s Landing? Watt Ave. access? Sunrise tube launch spot? Homeless encampments everywhere? Not all that sexy.

Photo by Pixabay on Pexels.com

This new project will be sure to revitalize the area! Check out the article here.

Best,

Keith Klassen, Real Estate Broker – 916.595.7900

Specializing in Residential Sales & Property Management

Posted in Real Estate

I posted about this last week – see New Brewery I’ve Been Waiting For. I did make it to the new brewery, Urban Roots last weekend for their grand opening on Saturday… it did not disappoint. Myself, my wife and a handful of neighbors biked down there on a gorgeous evening. Yes there was a line out the door and the bar was flooded with thirsty people, but what did I expect? I actually ran into a few friends and other neighbors while in line – shout out to Dr. Tom! The beer was on point and the food was way better than I expected. I guess I approach smoke house BBQ with a little hesitancy and low expectations in general. The price point was good and everything I had (pork shoulder, sausage, grits, fries) was super tasty! I was surprised by how fast the food came out and the staff seemed to be running like a clock – impressive. I guess they to practice the week before, as well as at Pangaea.

While other breweries (not to mention any names) are suffering from roaches and rats, Urban Roots is clean, spacious, and well-thought out. Thank you for bringing the vision to fruition.

Cheers,

Keith Klassen, Real Estate Broker – 916.595.7900

Specializing in Residential Sales & Property Management

Posted in Real Estate

Have you seen them around town and may have wondered, “What’s up with the red bikes?!” They are called Jump bikes. They appear to be left in random places… Wherever you want to leave them within a certain zone, you may do so. Oh course they are for rent, but the cost is super inexpensive. Check out their website for areas of use, cost, and details.

The keys is, they have power assist… each time you pedal… hold on because they will zip! My neighbor, who is retired, pick one up around the corner to fool around with it. Soon we were all out there taking spins.

I thought to myself, if a bunch of people in there 50 and 60’s (and a young guy like me – ha ha) can jump on and ride with no problem and love it, this is a hit! The other key is, they are fun! Check out this video of my first ride.

I could see us grabbing a couple of Jumps and cruising into Midtown for happy hour, or running a quick errand. Cheaper than an Uber (by the way, Uber owns Jump), and you could always get a car on the return trip if you’d like.

What do you think?

Cheers!

Keith Klassen, Real Estate Broker – 916.595.7900

Specializing in Residential Sales & Property Management

Posted in Real Estate

Photo by Lisa Fotios on Pexels.com

While Wabi-Sabi may be all the rage this year, I personally identify with (maybe some Swedish roots?) the “Lagom” design trend. Which one do you like most?

See article HERE

Be well!

Keith Klassen, Real Estate Broker – 916.595.7900

Specializing in Residential Real Estate Sales & Property Management

Posted in Architecture, Real Estate, Valuable Information

I can hear it now, “Another brewery!?” That’s just what we need in Sacramento [insert sarcasm]! In an era where breweries are the new pizza parlor… one on every corner, and one may wonder when the market will by saturated? As for now, there seems to be no slowing down. Urban Roots is poised to open this weekend, with a soft opening today and Friday, late afternoon. It’s on my to-do list. Oh and they have food! Yay! Not another brewery with a food truck! Thank you soooo much. While I understand the business of starting small and leading with revenue (aka, warehouse, beer tanks, picnick tables, corn hole/life-size jenga – we’ve all been there) … sometimes you just need to spend some money up front and do it right. I know these guys have been dreaming and planning this venture for years.

Photo by Little Visuals on Pexels.com

Shout out and big props to Rob Archie, owner of Pangaea, and Peter Hoey! I’ve never met Peter, but know his name from back in the day when he was one of the only guys in Sacramento making legit beer. I met Rob back when his shop was just serving coffee and muffins and he was catching flack from the old Coffee Garden for moving in on their territory. I remember Rob asking, “What will set apart my business from others?” His dream of a neighborhood, Italian cafe was coming to life, but something was missing. We talked many times about this, and I cannot take the credit, but I believe I may have said, um, “How about serving beer?” I’m sure many others said the same thing, proven by the continuous bustling patrons. The rest is history! A staple in Curtis Park and beyond. Also we dreamt of having a wine bar next door… Instead he opened up the wall and dropped a better, specialty beer bar – great decision!

I have high hopes and encourage you to check out Urban Roots Brewery and Smokehouse. Will report on findings soon.

Check out the article in the SacBee here

Cheers,

Keith Klassen, Real Estate Broker – 916.595.7900

Specializing in Residential Sales and Property Management